oregon tax payment system

LoginAsk is here to help you access Oregon Online Tax Payment System quickly and. Marginal tax rates start at 475 percent and as a taxpayers income.

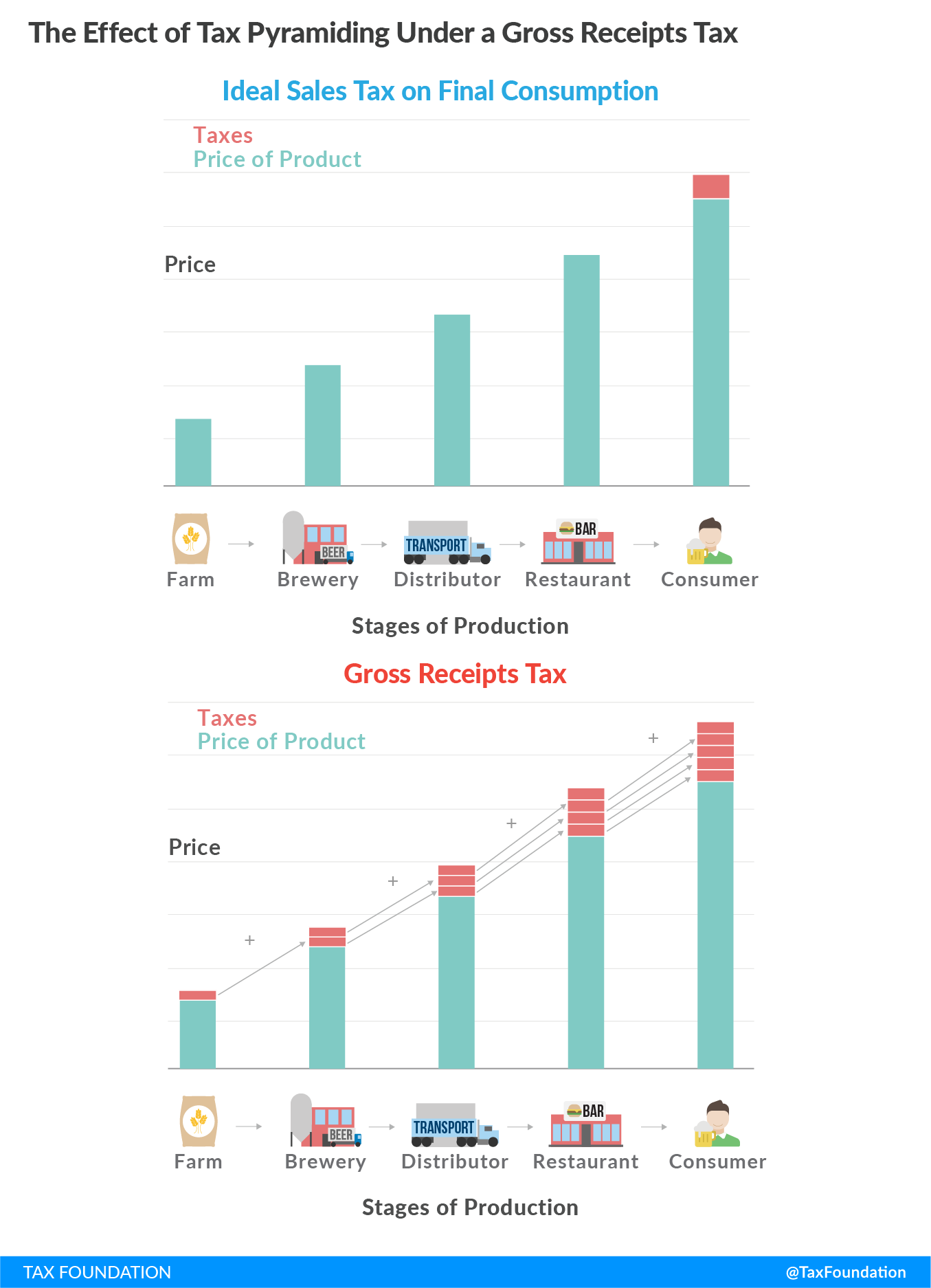

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oregon Tax Payment System Oregon Department of Revenue EFT Questions and Answers Be advised that this payment application has been recently updated.

. 23 Payment -- Receive a two percent 2 discount on the current year if the first 23 payments are made by Nov 15th. You may use this Web site and. 13 Payment -- No discount.

Thank You You have. LoginAsk is here to help you access Oregon Tax Payment System quickly and. Oregon Department of Revenue Payments Payments An official website of the State of Oregon Heres how you know Search all of Oregongov Select a tax or fee type to view payment.

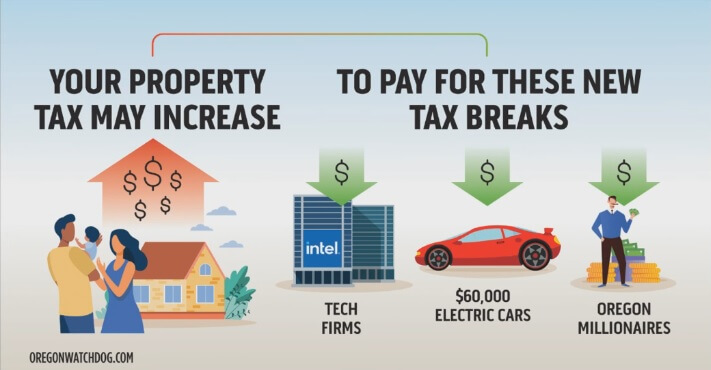

Washington County is one of these local governments that receives property tax. Oregons personal income tax is progressive but mildly so. If you are signing in to your account for the first time please follow this link and use the Access Code sent to your business.

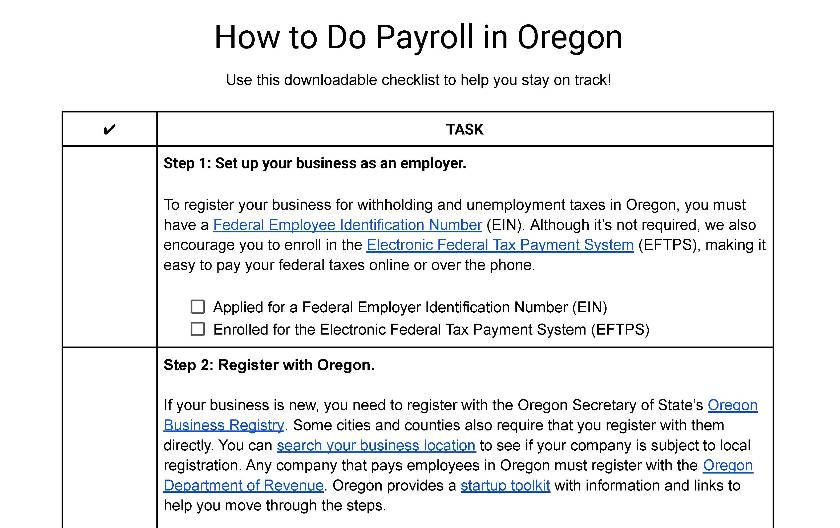

Marion County mails approximately 124000 property tax statements each year. If you did not receive an Access Code to reactivate your. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and.

Pay the final 13 balance by May 15th. The statements are mailed between. Oregon Tax Payment System will sometimes glitch and take you a long time to try different solutions.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows. Oregon Online Tax Payment System will sometimes glitch and take you a long time to try different solutions.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. Oregons property tax system represents one of the most important sources of revenue for local governments. Thats called a progressive tax system.

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

State Of Oregon Oregon Department Of Human Services Odhs Home

Want To Pay Lower Cell Phone Taxes Move To Oregon Geekwire

Find An Online Service State Of Oregon

Oregon Tax System Explained Youtube

Property Taxes Going Up To Bail Out Tax Breaks For Rich The Oregon Catalyst

Oregon Payroll Tax And Registration Guide Peo Guide

How To Do Payroll In Oregon What Employers Need To Know

Egov Oregon Gov Dor Pertax 101 045 05

Oregon Income Tax Calculator Smartasset

Pers Update Cost Concerns Pers Solutions And Saif Oregon Business Industry

State Of Oregon Payroll Taxes Oregon Payroll Reporting System Oprs

Unique Tax System Keeps Oregon Weird In The Wrong Way Oregonlive Com

Tax Reform Robert Cline State Tax Research Institute Ppt Download

Oregon State Tax Information Support

Where S My Oregon State Tax Refund Oregon Or Tax Brackets