b&o tax states

Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is. He also expressed support for legislation that would extend the states film and television tax credit program through 2030 and invest 165 billion in the program which is.

Why Our B O Tax Is Unfair R Seattlewa

States of Washington West Virginia and as of 2010 Ohio and by municipal.

. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline. The state BO tax is a gross receipts tax. Washington State BO Tax Treatment.

Washington state doesnt have income tax like most states but business owners do need to. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. If youre in the manufacturing category you wont have to pay B O tax until your annual income is at about 86000 with a sliding scale after that.

The Washington Policy Center an independent public-policy think tank says the BO is nationally recognized as one of the worst ways to tax businesses. The business and occupation tax often abbreviated as the B O tax is a type of tax levied by the US. The small business tax credit is broken up.

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Under GAAP for-profit enterprises have several allowable accounting conventions to record the ERC credit.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. California has among the highest taxes in the nation. Washington unlike many other states does not have.

Philadelphia in Pennsylvania has a gross receipts tax referred to as the Business Income and Receipts Tax BIRT. Washington State BO tax is based on the gross income from business activities. You can learn more about Philadelphias gross receipts tax.

The Washington Supreme Court recently reviewed the much-maligned additional Business Occupation BO tax on certain financial institutions. Please visit our State of Emergency Tax Relief page for additional information. It is measured on the value of products gross proceeds of sale or gross income of the business.

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates.

Boeing 39 S Jumbo Milestone The 1 500th 747 Passenger Aircraft Boeing Boeing Aircraft

N919ca Boeing 747 428 Bcf Jetphotos Com Is The Biggest Database Of Aviation Photographs With Over 3 Million Screened Photos Cargo Aircraft Boeing 747 Boeing

Vintage B O Railroad Train Print Locomotive E60 3114 9 25 X 11 75 Black And White

Klm Boeing 747 206b M Sud Ph Buk Louis Bleriot Vintage Airlines Boeing Boeing 747

B Amp O Tax Return City Of Bellevue

Railpictures Net Photo Baltimore Ohio B O Coal Dock At Lorain Ohio By Doug Lilly Lorain Lorain Ohio Ohio

N508kz Boeing 747 Thai Airline Boeing

Business And Occupation B O Tax Washington State And City Of Bellingham

B Amp O Tax Guide City Of Bellevue

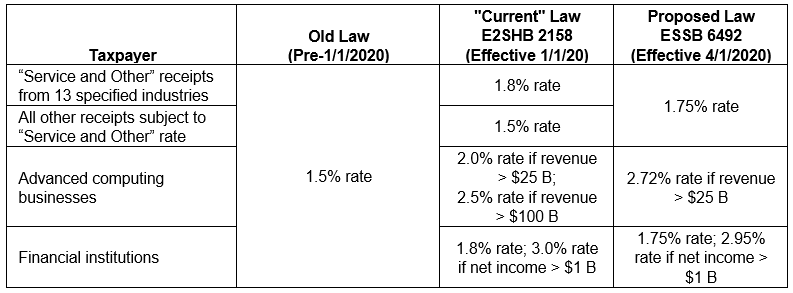

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Model Trains