what taxes do i pay after retirement

Unlike certain types of income such as qualified dividends or long-term capital gains no special tax treatment is available for pension income. Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes.

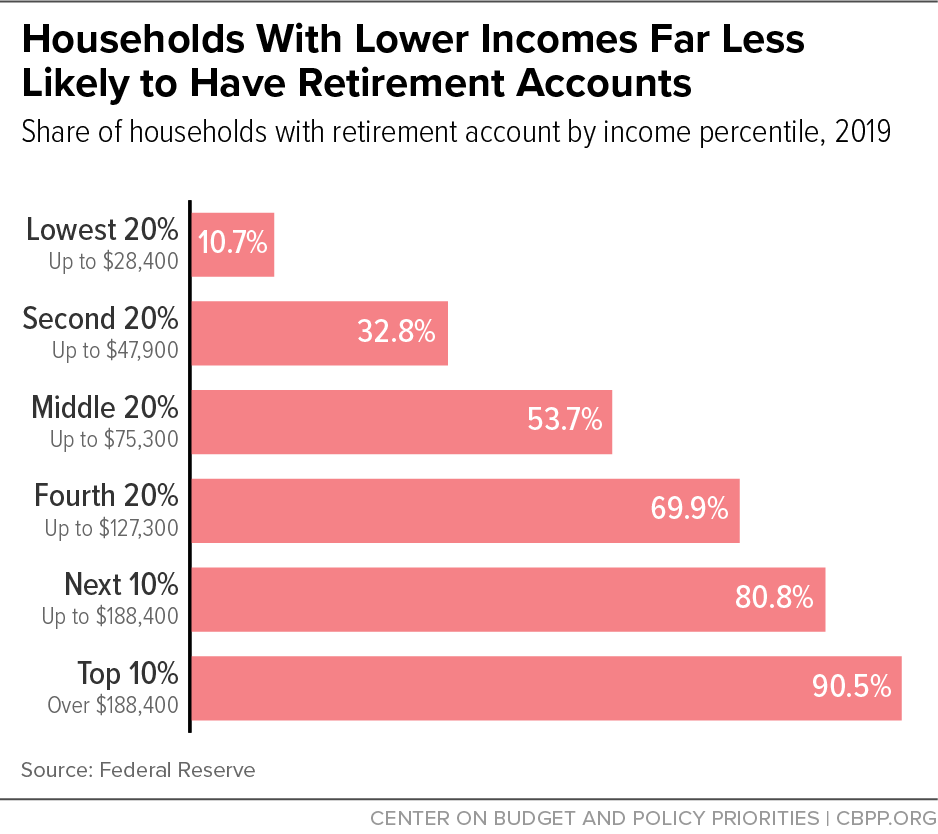

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Our Guidebook Will Teach You the Key Issues Many Face How to Overcome Them.

. Ad Free And Easy Tax Estimator Tool For Any Tax Form. Although Roth 401k has a few advantages you still need to pay Social Security. Here are 24 tips for keeping more of your money.

Chat With AARPs Digital Retirement Coach Can Help With A Personalized Action Plan. Ad Annuities help you safely increase wealth avoid running out of money. Ad Get Personalized Action Items on What Your Financial Future Might Look Like.

You can rollover over the funds into a new retirement plan without paying. You wont be charged taxes on the part of the payment that represents the after-tax portion you paid in. If you have a traditional 401 k youll pay a 401 k distribution tax when you take the funds out at retirement.

Those who qualify can contribute up to 6000 in 2020 or 7000 for people age 50 and older. Get your exclusive free annuity report. See How Easy It Really Is.

Ad A One-Stop Option That Fits Your Retirement Timeline. Your Social Security check will be reduced by 2720 that year or 1 for every 2 earned. 62 of wages for Social Security capped at 142800 of wages for 2021 and 145 of wages for Medicare no limit for a total.

Fisher Investments shares these 7 retirement income strategies to help you in retirement. What is the tax rate on 401k withdrawals after retirement. Discover The Benefits Of A Traditional IRA.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. How much tax do I pay on 401k withdrawal after 60. Ad A One-Stop Option That Fits Your Retirement Timeline.

Retirement taxes can be surprising. If you have 401 ks with former employers a rollover to a Roth. Under current law for 2018 the.

If you have a Roth 401k unlike the traditional 401k your contributions are made with after-tax money. Contributing to a Roth reduces your taxes in retirement because you pay taxes. Anyone who withdraws from their 401K.

In the year you reach your full retirement age you can. FICA taxes are broken down as follows. For retirees who begin receiving pension payments before age 55.

Learn About 2021 Contribution Limits Today. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans and tax. Ad Download The Definitive Guide to Retirement Income from Fisher Investments.

Ad Learn How to Manage Taxes in Retirement with Our Free Guidebook - Download Now. TD Ameritrade Offers IRA Plans With Flexible Contribution Options. Ad Experienced Support Exceptional Value Award-Winning Education.

Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item.

Open an Account Today. Discover The Benefits Of A Traditional IRA. Learn About 2021 Contribution Limits Today.

Access Insights On Retirement Concerns The Impact Of Taxes. There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will. This is 5440 over the limit.

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Tax Filing Tips For Saving Money On Your Taxes

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding The Mega Backdoor Roth Ira

What To Do With A 401k After Retiring From Your Employer Investing For Retirement Retirement Advice Retirement Strategies

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Top 3 Benefits Of Roth Ira Individual Retirement Account

The Best Retirement Vehicle You Ve Never Heard Of Www Americanwealthonline Com Ratho Reis Manager Ratho Awg Gma How To Plan Retirement Planning Retirement

Here S Why Some Retirees No Longer Have To File A Tax Return Retirement Money Social Security Benefits Retirement Retirement Benefits

9 States That Don T Have An Income Tax Income Tax Income Tax

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)